Henrik5000/iStock via Getty Images

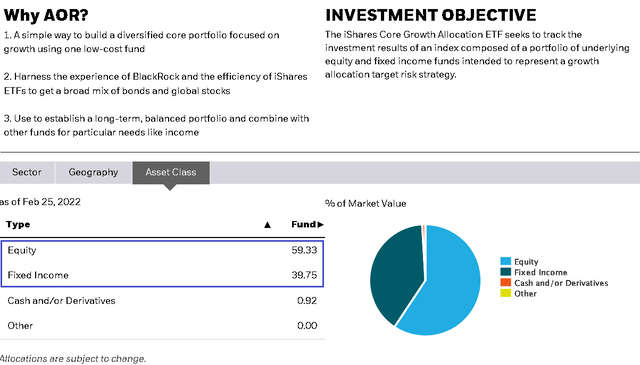

The iShares Core Growth Allocation (AOR) ETF provides broad equity and bond exposure through a portfolio of ETFs designed to track major benchmarks. AOR’s allocation, with a weighting of around 60% in equities and 40% in bonds, aims to have a balanced risk return profile. This type of diversification should limit the portfolio’s decline in a scenario where equities are volatile, which was the case at the start of 2022. The appeal of AOR is that it represents a simple method of investing in a strategy term as a core portfolio that can work in various market environments.

Looking for Alpha

What is the AOR ETF

AOR is an example of a multi-asset class allocation ETF. The term “growth” in the fund’s name refers to the equity tilt that is expected to generate capital appreciation over time. The strategy also calls for the portfolio to be rebalanced quarterly back to the 60/40 allocation to maintain fixed weightings.

source: iShares

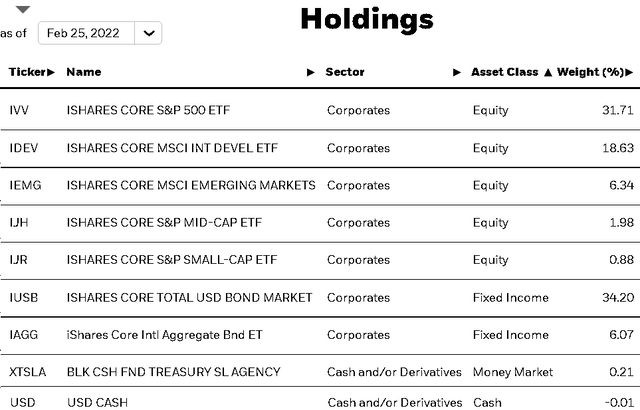

AOR uses other ETFs within the same iShares family of funds to capture exposure to key market segments. For stocks, the 32% weighting in the iShares Core S&P 500 (IVV) ETF is intended to track the widely followed large-cap index. Through IVV, the AOR ETF holds companies like Apple, Inc. (AAPL), Microsoft Corp. (MSFT) and Amazon.com, Inc. (AMZN) recognized as blue chips and market leaders.

The fund also includes the iShares Core MSCI International Developed Markets (IDEV) ETF with a weighting of 19%. The idea here is to be invested in large foreign stocks knowing that “developed markets” being countries in Europe as well as Australia, Japan and others are relatively lower risk than “developed markets”. in development”. What’s interesting about IDEV is that the portfolio includes over 2,200 stocks that highlight the broad reach of the AOR ETF.

That said, developing markets are also important and with AOR you get a 6% allocation through the iShares Core MSCI Emerging Markets (IEMG) ETF. IEMG’s underlying companies are from countries like China, India, Korea, and Brazil, among others. It is understood that this group is higher risk and more volatile than developed markets, but enjoys stronger potential for economic growth over the long term.

Finally, AOR also adds the iShares Core S&P 500 Mid-Cap (IJH) ETF and the iShares Core S&P Small-Cap (IJR) ETF which together represent a weighting of around 3%. Considering the five equity ETFs, AOR includes underlying exposure to over 5,500 individual stocks.

source: iShares

The other side of the diversification is fixed income with the AOR using two bond ETFs between a 34% stake in the iShares Core Total USD Bond Market ETF (IUSB) and 6% for foreign bonds with l iShares International Aggregate Bond ETF (IAGG).

IUSD is a broad-market bond ETF that includes full exposure to over 14,000 issues. The profile of the fund has an intermediate maturity profile considering an effective duration of 7 years. This means that the fund has a moderate sensitivity to interest rates and is a good proxy for “US bonds”. Similarly, IAGG provides exposure to US dollar-denominated bonds issued by foreign companies which often have a different credit risk profile than US companies, but end up contributing to diversification.

AOR Forward-Looking Commentary

If investors had a crystal ball to know that stocks, bonds, or any particular stock would outperform at all times, then the “60/40” investment strategy would be pointless. This uncertainty highlights the importance of holding both major asset classes.

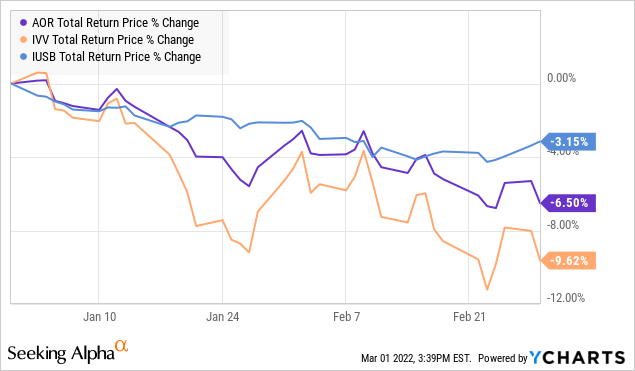

Year-to-date, in a historically difficult market environment, we note that the AOR with a -6.5% decline was able to outperform the S&P 500 via the IVV ETF which is down -9, 6%. This also takes into account the unique circumstance of bonds under pressure in 2022 in the face of rising interest rates, the IUSD ETF, which AOR uses for its fixed income exposure, is down -3.5 %. Overall, the fund performed its intended function of at least limiting volatility compared to simply owning 100% of stocks.

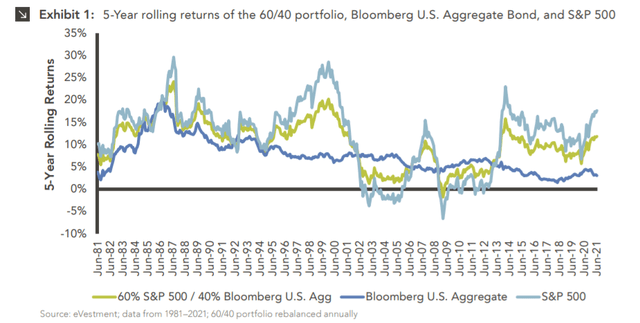

Data shows that over a 5-year period dating back to 1981, the S&P 500 has generated an average return of around 15%, compared to around 12% for a standard 60/40% strategy using the S&P 500 for equity exposure only with the Bloomberg US Aggregate Bond Index. While this implementation differs from the AOR ETF, the point here is to highlight that adding bonds to an equity portfolio helps limit overall volatility, making it a more conservative option compared to simply owning the S&P 500.

source: Marquette Associates

In a scenario where equities enter a sharp bear market as was the case during the 2008 financial crisis, the 60/40 strategy was able to limit losses through fixed income allocation. In this regard, AOR is an easy way to invest with a strategy that aims to be resilient in all types of market conditions.

How to invest in AOR

Still, the 60/40 strategy isn’t perfect, and there’s also an argument against the particular method AOR tries to use its ETFs. The first point here is that no strategy is perfect for every investor. 60/40 is sort of that long standing benchmark between stocks and bonds, but something like 70/30 or even 80/20 can make sense depending on goals, objectives, risk tolerance , the time horizon and the unique circumstances of each investor.

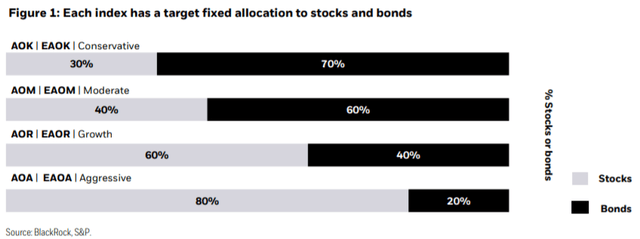

It’s worth mentioning that iShares offers a few other multi-asset class allocation ETFs that are an alternative to AOR, each with a different allocation between stocks and bonds while using the same underlying ETFs.

- iShares Core Conservative Allocation ETF (AOK) “30/70 stocks and bonds

- iShares Core Moderate Allocation ETF (AOM) Stocks and Bonds “40/60”

- iShares Core Aggressive Allocation ETF (AOA) “80/20” bond stocks

Separately, iShares also offers the same strategies that screen holdings for environmental, social and governance ratings through its “ESG Conscious Series”:

- iShares ESG-Aware Conservative Allocation ETF (EAOK)

- iShares ESG Aware Moderate Allocation ETF (EAOM)

- iShares Core Growth Allocation ETF (EAOR)

- iShares Core Aggressive Allocation ETF (EAOA)

source: iShares

BlackRock, Inc. (BLK), the sponsor of iShares, attempts to cover all the bases with something for everyone. The caveat we raise is that anyone holding AOR or any other of these allocation ETFs will start to drift away from the strategy if combined with individual stocks or any other exchange-traded fund.

Allocation ETFs can function as a core strategic portfolio while being complemented by more tactical positions through the portfolio management technique known as “core-satellite”. Just be aware that adding other positions besides the AOR will change the overall risk profile of the portfolio relative to the expected equity to fixed income ratio.

The individual funds AOR uses to capture equity exposure and the weightings chosen can also be discussed. For example, the 2.9% between small and mid cap ETFs within AOR is a bit low in our view. Depending on the market environment, it may make sense to overweight emerging markets or small caps relative to fixed AOR allocations.

Within the current AOR portfolio, certain market segments are also underweight relative to the universe of equities and fixed income investment opportunities. The fund lacks sectors such as precious metals, alternative investments, municipal bonds, preferred stocks, and currency-denominated bonds, among others, that might deserve a place in a diversified portfolio.

Final Thoughts

AOR is an attractive fund and a good option for investors who just want to keep things simple with a long-term buy-and-hold strategy. We are confident that an investment in AOR with regular monthly or annual contributions will generate positive long-term returns. That said, we also think investors could do a little better in terms of performance by taking a more semi-active approach or building their own portfolio allocation.

Going forward, we can expect volatility in stocks and bonds to continue in the short term. There are many uncertainties related to macroeconomic headwinds between the Russian-Ukrainian conflict, as well as high inflation, and the potential for slower growth. From a long-term perspective, we expect equities to generate positive returns that AOR will be well positioned to capture.